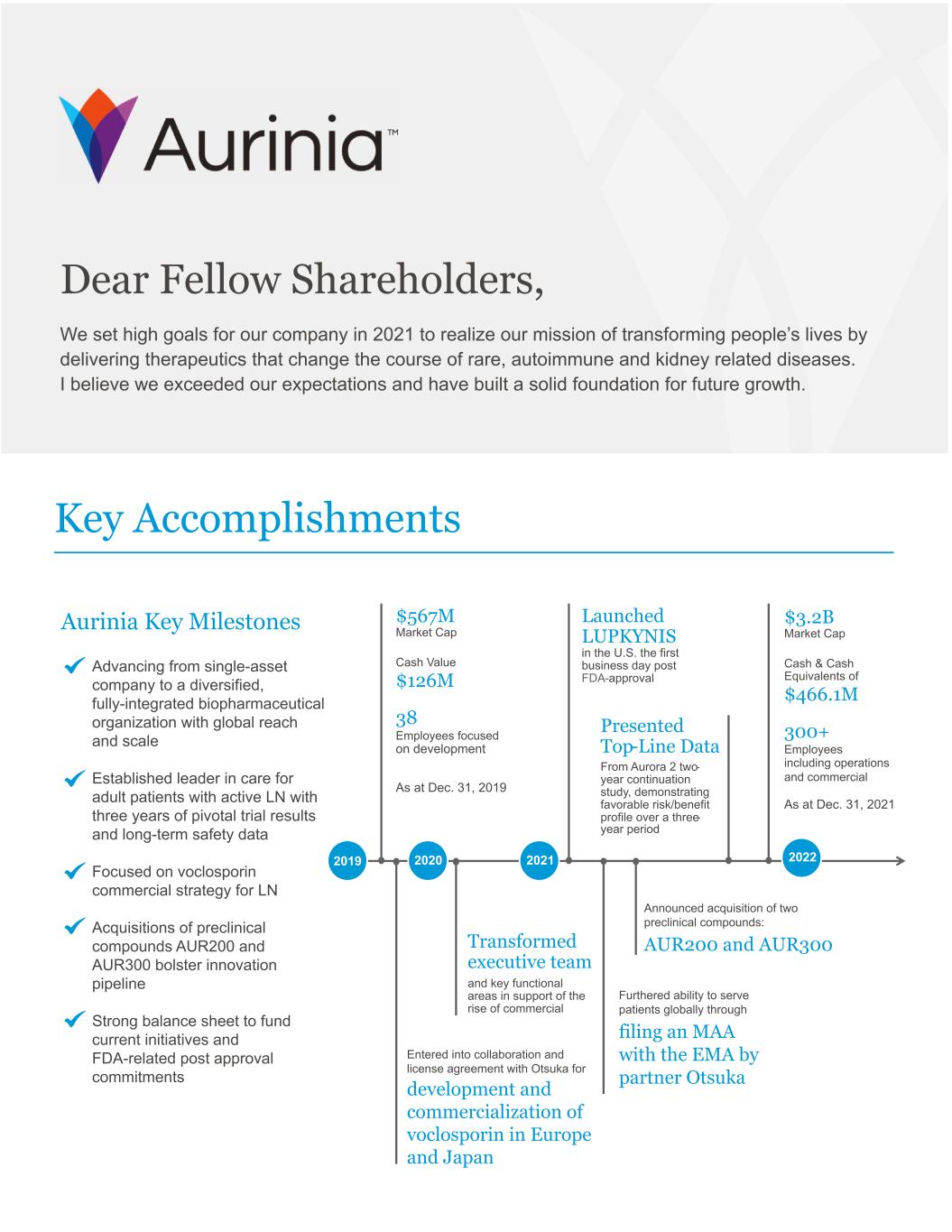

Key Accomplishments Dear Fellow Shareholders, We set high goals for our company in 2021 to realize our mission of transforming people’s lives by delivering therapeutics that change the course of rare, autoimmune and kidney related diseases. I believe we exceeded our expectations and have built a solid foundation for future growth. Aurinia Key Milestones Advancing from single-asset company to a diversified, fully-integrated biopharmaceutical organization with global reach and scale Established leader in care for adult patients with active LN with three years of pivotal trial results and long-term safety data Focused on voclosporin commercial strategy for LN Acquisitions of preclinical compounds AUR200 and AUR300 bolster innovation pipeline Strong balance sheet to fund current initiatives and FDA-related post approval commitments 2019 2020 2021 $567M Market Cap Cash Value $126M 38 Employees focused on development As at Dec. 31, 2019 Transformed executive team and key functional areas in support of the rise of commercial Launched LUPKYNIS in the U.S. the first business day post FDA-approval Furthered ability to serve patients globally through filing an MAA with the EMA by partner Otsuka $3.2B Market Cap Cash & Cash Equivalents of $466.1M 300+ Employees including operations and commercial As at Dec. 31, 2021 Announced acquisition of two preclinical compounds: AUR200 and AUR300 2022 Presented Top-Line Data From Aurora 2 two- year continuation study, demonstrating favorable risk/benefit profile over a three- year period Entered into collaboration and license agreement with Otsuka for development and commercialization of voclosporin in Europe and Japan

Establishing a Leadership Position in Lupus Nephritis This past year we made strong progress toward making LUPKYNIS the standard of care for adult patients suffering from active lupus nephritis (LN) through the achievement of many corporate milestones: “We received US FDA approval for LUPKYNIS after close of business on Friday, January 22nd, 2021, and were able to launch our first commercial product the following business day, which speaks to the extraordinary launch readiness of our team” • We received US FDA approval for LUPKYNIS after close of business on Friday, January 22nd, 2021, and were able to launch our first commercial product the following business day, which speaks to the extraordinary launch readiness of our team. • Since the launch of LUPKYNIS, we have secured a total of 1,773 patient start forms as of February 25, 2022 – which helps validate the product’s awareness, adoption and access amongst healthcare professionals and the community at large. • We achieved $45.6 million annual revenue for the full year, which was in line with our revenue guidance initially provided on August 5, 2021. • Together with our partner Otsuka, we filed a marketing authorization application (MAA) for the approval of voclosporin by the European Medicines Agency (EMA). This was a key step toward globalizing our products and enabling access for patients beyond the US. • The Lancet, an international peer-reviewed medical journal, published the LUPKYNIS pivotal registrational study in May 2021. • In December 2021 we presented top-line data from the AURORA 2 two-year continuation study, the longest LN study to date, demonstrating a favorable risk/benefit profile for voclosporin over a three-year period, with safety comparable to AURORA 1, and sustained efficacy.

Creating a Strong Pipeline In addition to the progress we made with LUPKYNIS, we bolstered our pipeline with two new innovative programs. We announced the acquisition of two novel, preclinical compounds: AUR200 and AUR300. Adding these assets, as well as building out our capabilities in research, translational medicine and process development, has helped us advance our goal from being a single-asset company towards a diversified, fully integrated biopharmaceutical organization. We also significantly improved our capital position by ending the year with cash and cash equivalents of $466.1 million, which provides us with the necessary financial resources to fund our current objectives, of fueling our commercial launch, funding our growing pipeline, meeting our FDA-related post-approval commitments and executing on our business development strategy. Our achievements related to the approval and launch of LUPKYNIS, along with strengthening our pipeline, helped drive our share performance and outpace the major biotech stock indexes over the last 1 and 3-year time periods, respectively. “Our achievements related to the launch of LUPKYNIS and the strengthening of our pipeline helped drive our share performance appreciation against biotech stock indexes during 2021” Engaging with our Shareholders and Maintaining High Standards of Corporate Governance Throughout the course of the approval and launch process this past year, our management team made a focused effort to engage with our shareholders to ensure they were properly apprised of our corporate strategy and recent developments, and to hear our investors’ views on matters important to the business. Overall, we were pleased by the support of our investor-base and the engagement regarding our company’s progress on multiple fronts over the past year, as well as future growth initiatives and other topics of interest, such as our approach to Environmental, Social and Governance matters. Responsibility also means ensuring high standards of corporate governance. Aurinia has an independent, diverse and highly qualified Board that continually seeks to raise the bar with regards to governance, diversity and expertise. In June 2021, we appointed Dr. Brinda Balakrishnan to the Board of Directors, who brings a wealth of experience in medicine, biotech business development and the rare disease sector. We expect Dr. Balakrishnan’s expertise and counsel to be extremely valuable as we work to change the course of LN and other autoimmune diseases.

Closing Remarks All of these initiatives were undertaken against the backdrop of COVID-19, which affected the healthcare industry and disproportionately our business due to the immune compromised nature of our patients. Despite this challenge and others, our employees rose to the occasion, and we believe we have exceeded our high expectations. Both management and the Board are extremely proud and honored to work with such a capable and skilled group of employees. In closing, I would like to thank our shareholders. You have trusted us with your capital, and we do not take that for granted. We look forward to continuing to build a sustainable, value-creating bio-pharmaceutical company. We encourage you to vote at our annual general meeting of shareholders and we thank you for your continued support. Sincerely, Peter Greenleaf Director, President and Chief Executive Officer